As GE prepares for its Mind and Machines Internet of Things (IoT) conference, it added an interesting item to the agenda with the purchase of field service powerhouse ServiceMax for $915m (Press Release). ServiceMax has previously had a footprint in several GE businesses (since Sept 2010) and now GE expects to connect and extend its Industrial Internet of Things (IIoT) vision and Predix platform into the field.

It’s long been rumored that ServiceMax would eventually be bought. Initial signals pointed to Salesforce, the platform on which ServiceMax was built. As Salesforce began the pursuit of its own field service journey, most eyes turned to PTC. Yet, $900m or so seems like an asking price that PTC was unlikely to swallow given its wave of IoT and service investments.

Our First Take (of Many)

First and foremost, this is a big field service play. Recent acquisitions of enterprise field service software providers have been in the $400-$500m range and this is quite an investment by GE Digital. GE’s transformation from industrial giant to digital partner has been well documented and the company most recently purchased Meridium and its Asset Performance Management capabilities. Where Meridium excels in enhancing maintenance processes within the four walls of a manufacturing facility, ServiceMax offers a similar value proposition for assets in the field. The same type of machine performance data and intelligence can be used to:

- Improve reactive service and maintenance opportunities

- Develop predictive support models

- Develop new products and services (driven by service information)

- Develop new relationship models (output-based, consumption-based)

ServiceMax’s enterprise customers and prospects will greatly benefit from the added investment, especially in the areas of connected field service and analytics. A number of these enterprise organizations are looking for assistance in the development and execution of their IoT roadmap and strategy, and the GE Digital-ServiceMax combination will likely offer the key components in a productized form. (Note: ServiceMax and PTC currently offer a connected service product for which the organizations have recently signed early customers)

For GE Digital, the purchase opens up IoT-ready verticals in medical devices, building services, and Industrial Manufacturing. While many within these industries already have pockets of an IoT strategy (primarily for reactive service or predictive maintenance), these organizations are making build vs. buy decisions on their future IoT roadmaps and are looking for partners to help them get started.

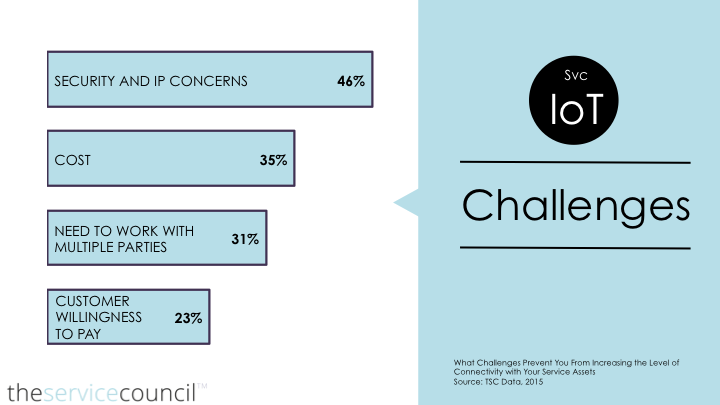

From a broader IoT perspective, GE’s investment points to the fact that improved service and maintenance processes still offer the clearest form of ROI when it comes to IoT investments. While IoT and IIoT holds a lot of promise, very few organizations have really been able to scale into servitized business and operating models. This takes time. For a number of organizations, servitized models only work with products that were designed and manufactured with connectivity in mind. But in a world where customers continue to hang on to legacy equipment, there is work to be done. (See challenges below)

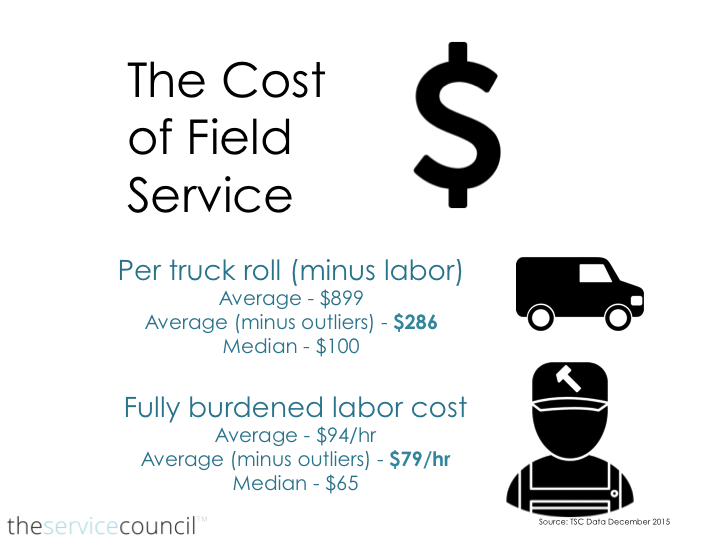

Yet, organizations understand the language of efficiency. Field service is still bogged down by manual processes and even though mobile devices are common in the hands of field service teams, most organizations have only leveraged mobile capabilities to replace paper-based forms. A greater use of mobility promises further efficiency gains and this continues to be the major selling point of mobile applications even though the revenue and customer experience ramifications are significant. Most organizations want to get some quick wins from a cost-saving and efficiency point-of-view before they have the bandwidth to invest in other capabilities.

It is the same with IoT. Organizations want to use enhanced intelligence to reduce unnecessary field service visits. In the case where field service is necessary, service organizations want to make sure that first-time fix rates are high. Moving the needle on a first-time fix from low 70s to the high 70s or mid 80s can have significant cost ramifications (as seen from our data below). These are easier, more measurable wins that can be pointed to as organizations collect more and more data to enable more predictive service algorithms. It also offers a greater deal of time for service organizations to implement a digital-first strategy, one where products are designed, manufactured, and sold with connectivity in place.

The vision of IoT is easy to understand. Converting that vision into action has been difficult for a number of organizations for many reasons (unclear and overlapping IoT landscape, poor transformation roadmaps, a lack of connected solutions). Connected service or connected manufacturing products offer organizations a way to reap the early benefits of IoT while focusing in on a long-term digital strategy. We anticipate that GE Digital’s purchase of ServiceMax will offer service and manufacturing organizations the opportunity to scale with focused IoT-enabled products while planning out an overall digital strategy.

We will have additional comments regarding this over the coming weeks. We’re currently in the throes of an IoT-related research project where service organizations are telling us about their strategies to address key IoT-related challenges. If interested in participating, do reach out to me.

Update 1: Had the chance to speak with ServiceMax co-founder Athani Krishnaprasad. I’ve known Athani for a long time and it was great to hear the excitement about the future of ServiceMax, as part of the GE brotherhood. He did confirm that the worlds of field service and asset management (ServiceMax and Meridium) are converging and that GE’s vision is to bring together the manufacturers and consumers of industrial machines with the aid of data. In a connected world, output and performance are responsibilities of both parties and it won’t just be the manufacturer’s field service engineer who has access to service information. The customer (plant manager, facility manager) will also play an increasingly informed role in service decision-making.

Update 2: We’ve spoken to several ServiceMax and ThingWorx customers for their comments on the acquisition. Most welcomed the investment in field service and in ServiceMax’s capabilities but believe that it’s too early to tell. Others were unclear on how the GE Digital-PTC-ServiceMax trifecta will work moving forward. We anticipate that there might be more on the horizon at Minds and Machines.